“Vimahat’s corporate tax needs to be reduced a bit.” Our management costs are getting higher and higher. Management costs are high because we must spend on marketing to expand our business. Because of this investment,

management costs increase.

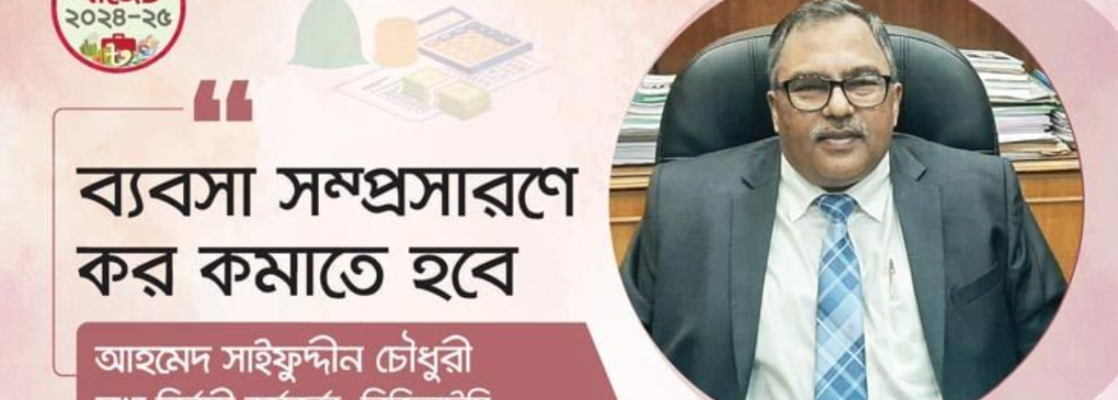

Ahmed Saifuddin Chowdhury spoke about securing the country. Saifuddin Chowdhury, who started his career in insurance, is a long-time CEO of Bangladesh General Insurance Company (BGIC). He recently spoke to Jago News about what benefits should be given to the insurance sector in the next budget, hurdles in the insurance field, ways to expand the business, bring in new products, etc. The interview was conducted by Saeed Shipan,

What are your expectations for the insurance sector in the upcoming budget?

Non-life insurance companies collect value-added tax (VAT) from consumers and return it to the government treasury. Better to reduce VAT from 15% to 10% in the next budget to protect insurance. Every person thinks about whether to sell their product in the market according to the cost. If the product price is higher than in other countries, the price will be too high, and it will not sell. Then, the number of insurance customers will decrease. The government will benefit if the tax is lower and the volume is higher.

Stopping the car insurance was the wrong decision. There should be car insurance. Since cars are not the only ones that are damaged, people can also be damaged. Car insurance should be reformed rather than discontinued.

The number of insurance customers has been decreasing recently.

Insurance premium rates in our country are high and operate on tariffs. Tax and VAT should be reduced to reduce the premium. It should also be non-tariff. If non-tariffing is done, it will be seen that an import for one thus finds the market and sells it for 20-30 paisa. This will increase the volume. If the volume increases, the insurance company will also grow as the government receives revenue.

Business expansion should reduce taxes.

What are the rates abroad?

Non-tariffing for foreign countries. If we take India as an ideal, it is a non-tariff market. Pakistan is non-tariff. Bangladesh should also become non-tariff.

How do you see the insurance profit tax rate?

The insurance tax should be reduced a little. Our management costs are getting higher and higher. The cost of management is high because the business must spend on marketing to expand. Because of this investment, management costs increase. However, if the corporate tax is cut, every company can do a lot to expand insurance coverage.

Another thing is that the government deducts tax from dividends paid by listed companies to shareholders. A company distributes dividends after paying taxes on the income it receives from the business, so the same amount is taxed twice. I think the shareholder dividend tax should be eliminated. I think it would attract more investment to the stock market.

The thought of minimizing fees using past “learning.”

Another round of increased costs!

There is no need for new mega projects in the next 2-4 years

After the car’s insurance was terminated, initiatives were taken to get it back. What do you think ABOUT this?

Stopping car insurance was the wrong decision. I think there should be car insurance. Since not only cars are damaged, people can be damaged as well. In my opinion, car insurance should be reformed rather than discontinued. Now, the car insurance claim fee is 20 thousand rupees. Twenty thousand rupees is not much these days. It is payable in Rupees Two Lakhs. In case of material damage, the compensation is R50,000, which can be increased to R3 million.

To introduce new products, those working in product development at Bimaha with 25 years of experience should be retired. At the same time,

the latest generation should have the opportunity to work.

In this case, a voluntary approach to payment can be offered. If the customer does not take 30% of the compensation, the insurance company can give the customer a 40% discount on the premium. If the customer does not receive 50% compensation, the company can offer a 60% discount on the premium. This will also lower your premium rate.

What new products should be introduced for the development of the insurance sector?

- The protesting job aspirants broke the police barricade and blocked Shahbagh Junction in the capital

To introduce new products, those working in product development at Bimaha with 25 years of experience should be retired. At the same time,